Basic market mechanics and trade types

3 posters

Page 1 of 1

Basic market mechanics and trade types

Basic market mechanics and trade types

Question: There is a buyer and seller in each transaction on the stock market, so how does the price ever go up or down? When you sell someone else is buying, and when you buy, someone else is selling.

Answer: There is not just one buyer and one seller, and they do not trade at exactly the same time, and not everyone accepts the market rate. Buyers submit a request to buy at a certain price (ask), and sellers will quote a price they are willing to sell at (bid). The difference between the two is the spread. You should always watch to ensure the spread is close. What is reported on most stock tickers is the last price someone paid, and is not necessarily the same price you will get, since there may only have been one person willing to sell at that price. I believe there is manipulation of the bid-ask spread to catch those making market orders, but I don't know the process well enough to describe how it is done. Regardless, be sure to use limit orders to avoid this problem.

When you submit an order overnight, you may notice sometimes that the following morning, the price will be completely different from what it closed at the night before. This results from the balance of unfulfilled orders when the market opens, which will change the bid-ask prices.

Question: Who moves the market?

Answer: I spent a lot of time at first trying to figure out the psychology of the markets and make up a strategy based on that. While I am no economist, I believe based on pure inference that individual investors barely make a dent on the overall market. The guys with real money making things move are pension funds managers, mutual fund/hedge fund managers, and super rich individuals. All of these have better information than you do. On top of that, they own the news. Fox is owned by newscorp, which is owned by ...., ....., ..... CNBC is owned by NBC, which is owned by ...., ....., .....

I like to think what I would do in such a situation. I would spread bad news, wait for everyone to bid down the price, and buy, then spread good news, wait for people to bid up the price of the stocks, and sell, and back and forth like a see-saw. If you follow the patterns of some of the most publicized companies like BP during a crisis, this is generally what happens. This is why it sometimes rewards you to rely on something other than the news, so you can confidently buy when the panic hits (something I try to do in theory, but often fail at in practice).

With the above points in mind, I will list the basic types of trades (you are probably already familiar with these and may be even more experienced than I am):

Market order - submits a request to buy or sell a stock at the best price currently available. Now this is a subjective trade, which gives your broker a lot of room to manoevre. If the market is moving quickly, or if you make the trade overnight, there may be a large difference between the price you get and the price you though you were going to get.

Limit Order - submits a market order to buy or sell a stock at or better than a target price once it reaches the target price during trading. My preferred trade type to ensure I get the price I want. Eg. Stock price is currently $5.00, and I set a limit order to buy at $4.50. If the stock price never goes below $4.51, my order is never triggerred. With these, you also get to place a time limit on the order, so you can keep it active for up to one month or so.

Stop Loss - submits an order to buy or sell a stock at or worse than a target price once it reaches the target price during trading. While at first glance, this may seem like a good idea to put a stop loss just behind the current price; if it rises, you profit and if it falls, you don't lose any money. However, you have to keep in mind that the market moves significantly each day, and on rare occasions, can drop to obscene levels. With a stop loss, you often trigger the order accidentally and end up selling at a loss when you didn't want to. Then the stock will subsequently rise and you will miss the profits. You might consider setting a very generous stop loss at a low price, but you should be very afraid that this too might be triggered. Keeping in mind that the farther away from the average, the more likely the stock is to rebound, do you really want to accidentally sell at the bottom and have the stock rebound without you? My advice is to stay away from stop loss orders (although it might have come in useful with Questerre). Eg. Current stock price is $5.00, stop loss set at $4.50. If stock price never goes below $4.51, my order is never triggered. There is also a stop buy (I guess it should be called stop gain) order, but I have never heard of a strategy for using it.

Stop Limit - Never used one of these, but I understand that it tries to overcome some of the limitations of the stop loss order by setting the stop loss order only after a limit price has been reached. This could allow a "hook" strategy, where a stop loss is placed once the stock gains $0.50 from the current level.

What next? If you are into some really advanced strategies, you can give options a try. Not my game, so I am no expert, but there is big money to be made for those who know how to offset risks properly. Basic idea is to trade the profit from the stock without investing all working capital into the price of the stock itself. You buy the "option" to purchase a stock (call option), or the option to sell a stock (put option) at a specified price.

Therefore, with $10,000, you could afford 100 shares of a stock trading for $100 or you could buy 1000 options for $10 each (random price for example purposes). If the stock goes up $10, your profits from owning the stock would only be $1,000 (100 x $10), while your profits from the options would be $10,000 (1000 x $10).

The thing to keep in mind about options is that if the stock trades in the opposite direction of your option, your option is worthless and you have 100% loss. Tempting to think that you downside risk is limited only to your investment, but in the case of put options, the stock price can rise indefinitely, and your losses are theoretically unlimited. Add to this the huge commissions and spreads in the bid-ask prices, and you have a very expensive and high stakes investment, and it is very hard to make enough profit to cover these costs.

Answer: There is not just one buyer and one seller, and they do not trade at exactly the same time, and not everyone accepts the market rate. Buyers submit a request to buy at a certain price (ask), and sellers will quote a price they are willing to sell at (bid). The difference between the two is the spread. You should always watch to ensure the spread is close. What is reported on most stock tickers is the last price someone paid, and is not necessarily the same price you will get, since there may only have been one person willing to sell at that price. I believe there is manipulation of the bid-ask spread to catch those making market orders, but I don't know the process well enough to describe how it is done. Regardless, be sure to use limit orders to avoid this problem.

When you submit an order overnight, you may notice sometimes that the following morning, the price will be completely different from what it closed at the night before. This results from the balance of unfulfilled orders when the market opens, which will change the bid-ask prices.

Question: Who moves the market?

Answer: I spent a lot of time at first trying to figure out the psychology of the markets and make up a strategy based on that. While I am no economist, I believe based on pure inference that individual investors barely make a dent on the overall market. The guys with real money making things move are pension funds managers, mutual fund/hedge fund managers, and super rich individuals. All of these have better information than you do. On top of that, they own the news. Fox is owned by newscorp, which is owned by ...., ....., ..... CNBC is owned by NBC, which is owned by ...., ....., .....

I like to think what I would do in such a situation. I would spread bad news, wait for everyone to bid down the price, and buy, then spread good news, wait for people to bid up the price of the stocks, and sell, and back and forth like a see-saw. If you follow the patterns of some of the most publicized companies like BP during a crisis, this is generally what happens. This is why it sometimes rewards you to rely on something other than the news, so you can confidently buy when the panic hits (something I try to do in theory, but often fail at in practice).

With the above points in mind, I will list the basic types of trades (you are probably already familiar with these and may be even more experienced than I am):

Market order - submits a request to buy or sell a stock at the best price currently available. Now this is a subjective trade, which gives your broker a lot of room to manoevre. If the market is moving quickly, or if you make the trade overnight, there may be a large difference between the price you get and the price you though you were going to get.

Limit Order - submits a market order to buy or sell a stock at or better than a target price once it reaches the target price during trading. My preferred trade type to ensure I get the price I want. Eg. Stock price is currently $5.00, and I set a limit order to buy at $4.50. If the stock price never goes below $4.51, my order is never triggerred. With these, you also get to place a time limit on the order, so you can keep it active for up to one month or so.

Stop Loss - submits an order to buy or sell a stock at or worse than a target price once it reaches the target price during trading. While at first glance, this may seem like a good idea to put a stop loss just behind the current price; if it rises, you profit and if it falls, you don't lose any money. However, you have to keep in mind that the market moves significantly each day, and on rare occasions, can drop to obscene levels. With a stop loss, you often trigger the order accidentally and end up selling at a loss when you didn't want to. Then the stock will subsequently rise and you will miss the profits. You might consider setting a very generous stop loss at a low price, but you should be very afraid that this too might be triggered. Keeping in mind that the farther away from the average, the more likely the stock is to rebound, do you really want to accidentally sell at the bottom and have the stock rebound without you? My advice is to stay away from stop loss orders (although it might have come in useful with Questerre). Eg. Current stock price is $5.00, stop loss set at $4.50. If stock price never goes below $4.51, my order is never triggered. There is also a stop buy (I guess it should be called stop gain) order, but I have never heard of a strategy for using it.

Stop Limit - Never used one of these, but I understand that it tries to overcome some of the limitations of the stop loss order by setting the stop loss order only after a limit price has been reached. This could allow a "hook" strategy, where a stop loss is placed once the stock gains $0.50 from the current level.

What next? If you are into some really advanced strategies, you can give options a try. Not my game, so I am no expert, but there is big money to be made for those who know how to offset risks properly. Basic idea is to trade the profit from the stock without investing all working capital into the price of the stock itself. You buy the "option" to purchase a stock (call option), or the option to sell a stock (put option) at a specified price.

Therefore, with $10,000, you could afford 100 shares of a stock trading for $100 or you could buy 1000 options for $10 each (random price for example purposes). If the stock goes up $10, your profits from owning the stock would only be $1,000 (100 x $10), while your profits from the options would be $10,000 (1000 x $10).

The thing to keep in mind about options is that if the stock trades in the opposite direction of your option, your option is worthless and you have 100% loss. Tempting to think that you downside risk is limited only to your investment, but in the case of put options, the stock price can rise indefinitely, and your losses are theoretically unlimited. Add to this the huge commissions and spreads in the bid-ask prices, and you have a very expensive and high stakes investment, and it is very hard to make enough profit to cover these costs.

Max- SDDL Insider

- Posts : 297

Reputation : 7

Join date : 2010-07-01

2nd level quotes

2nd level quotes

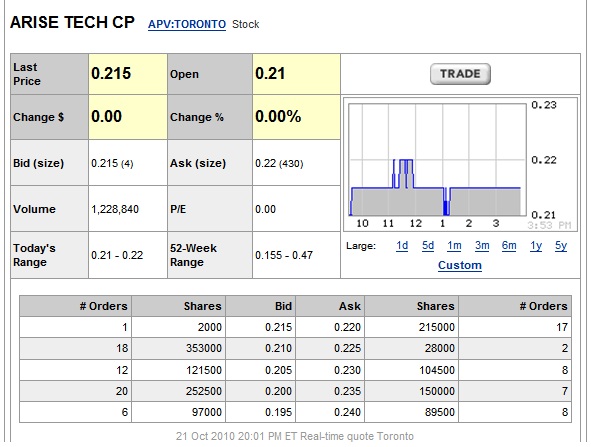

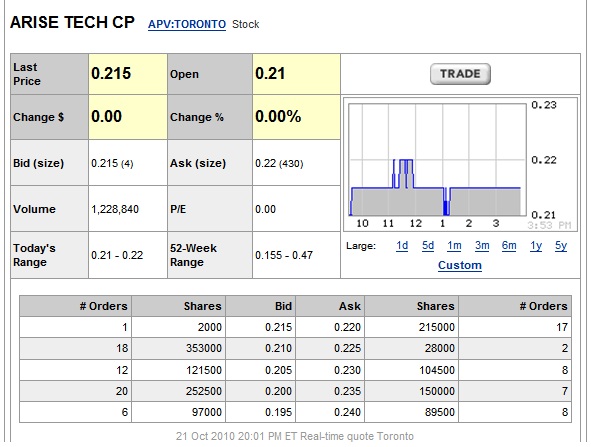

A bit of information pertaining to the first part of your post.

Ever think someone is watching you when you place an order? You are being cautous and place a stop loss order at what you think is a safe place (where you don't want to loose too much). Somehow, the share price drops to exactly that level, triggerring your stop loss and then immediately rebounds. You're left wondering WTF? Can someone see what I set my stop limit at? Well, truth is, yes. They are called second level quotes. I had the luxury of being able to see them for a few months. You are able to see the number of shares people are willing to buy (or sell) and the price they are bidding (or asking). For example if a stock is priced at $1.00, you would be able to see how many shares people want to buy and sell at each price interval near the stock price (which is usually in a range around the current share price). For example, you would see two columns that look like this:

Bid (Shares/Price) Ask (Shares/Price)

5000/0.99 1000/1.00

1000/0.98 30000/1.01

10000/0.97 2000/1.02

etc. etc.

I lost this capability and was told I need to be an active trader to get it back. I'm working on that. But I'll advise when I can see them again. It can also be very useful to know how big some orders are, and when you should be getting in, or when you should be staying away.

Ever think someone is watching you when you place an order? You are being cautous and place a stop loss order at what you think is a safe place (where you don't want to loose too much). Somehow, the share price drops to exactly that level, triggerring your stop loss and then immediately rebounds. You're left wondering WTF? Can someone see what I set my stop limit at? Well, truth is, yes. They are called second level quotes. I had the luxury of being able to see them for a few months. You are able to see the number of shares people are willing to buy (or sell) and the price they are bidding (or asking). For example if a stock is priced at $1.00, you would be able to see how many shares people want to buy and sell at each price interval near the stock price (which is usually in a range around the current share price). For example, you would see two columns that look like this:

Bid (Shares/Price) Ask (Shares/Price)

5000/0.99 1000/1.00

1000/0.98 30000/1.01

10000/0.97 2000/1.02

etc. etc.

I lost this capability and was told I need to be an active trader to get it back. I'm working on that. But I'll advise when I can see them again. It can also be very useful to know how big some orders are, and when you should be getting in, or when you should be staying away.

Re: Basic market mechanics and trade types

Re: Basic market mechanics and trade types

Fred,

Are you talking about something like this?

Are you talking about something like this?

lukera- Admin

- Posts : 174

Reputation : 0

Join date : 2010-07-01

Age : 43

Location : sault ste. marie, on

Re: Basic market mechanics and trade types

Re: Basic market mechanics and trade types

More or less, that's it. You don't get that with banks unless you're an active trader. Other trading platforms use it. I think it should be available for anyone. Which do you use?

Re: Basic market mechanics and trade types

Re: Basic market mechanics and trade types

I'm going to be using scotia iTrade (that's where i got the screenshot).

I haven't posted anything about them yet because they are sitting on my deposit still. Once they clear my initial cheque then I am clear to trade.

Maybe there is some kind of reliable stand-alone trading software you can download to track the market? I will try and look for something tonight.

I haven't posted anything about them yet because they are sitting on my deposit still. Once they clear my initial cheque then I am clear to trade.

Maybe there is some kind of reliable stand-alone trading software you can download to track the market? I will try and look for something tonight.

lukera- Admin

- Posts : 174

Reputation : 0

Join date : 2010-07-01

Age : 43

Location : sault ste. marie, on

Re: Basic market mechanics and trade types

Re: Basic market mechanics and trade types

Wow, I always suspected, but never knew for sure.

Fred, I am in the process of shopping around, I will try and post a survey of most of the banks and their fees, but as far as RBC is concerned, am I able to get the same low commission rate for RRSP, TFSA, and non-registered accounts (by combining the balances)? CIBC is not very good for this, since they want me to buy a separate trade package of 50 trades for each account ($400 each). I can use up 50 no problem, but 150 is stretching it (though I might come close this year).

If I leave the standard commission structure, it is hard to make money, since the commissions are somewhere around $30 per trade.

What about iTrade, anybody know if the low commission rate can be shared accross multiple accounts?

Fred, I am in the process of shopping around, I will try and post a survey of most of the banks and their fees, but as far as RBC is concerned, am I able to get the same low commission rate for RRSP, TFSA, and non-registered accounts (by combining the balances)? CIBC is not very good for this, since they want me to buy a separate trade package of 50 trades for each account ($400 each). I can use up 50 no problem, but 150 is stretching it (though I might come close this year).

If I leave the standard commission structure, it is hard to make money, since the commissions are somewhere around $30 per trade.

What about iTrade, anybody know if the low commission rate can be shared accross multiple accounts?

Max- SDDL Insider

- Posts : 297

Reputation : 7

Join date : 2010-07-01

Re: Basic market mechanics and trade types

Re: Basic market mechanics and trade types

Yes, I get my commission rates of $9.95/trade based on the ballance of the sum of all my accounts. Also, it appears that if you are making multiple trades of the same stock in one day, they don't always charge you for all of the trades, but rather lump them together.

Re: Basic market mechanics and trade types

Re: Basic market mechanics and trade types

Looks like CIBC is back in the race.

http://micro.newswire.ca/release.cgi?rkey=1810286884&view=14730-0&Start=0&htm=0

So much for negotiating. I called and as of January, they are discontinuing the trade package and just giving the flat $6.95 per trade including RRSP and TFSA accounts if balance is over $100k. Works for me, guess I am staying with CIBC after all.

Also, flat rate of $10 per trade if balance is over $50k.

The news seems to suggest that there are currently price wars going on, and you can expect to see lower commissions at the other brokerages as well.

The only other thing to consider is DAT (Direct Access Trading), which is a topic I will cover on another post (learning lots from the library).

-Eric

p.s. Fred, I like the new stock analysis format. Need more numerical analysis/justification, but provides a good overview.

http://micro.newswire.ca/release.cgi?rkey=1810286884&view=14730-0&Start=0&htm=0

So much for negotiating. I called and as of January, they are discontinuing the trade package and just giving the flat $6.95 per trade including RRSP and TFSA accounts if balance is over $100k. Works for me, guess I am staying with CIBC after all.

Also, flat rate of $10 per trade if balance is over $50k.

The news seems to suggest that there are currently price wars going on, and you can expect to see lower commissions at the other brokerages as well.

The only other thing to consider is DAT (Direct Access Trading), which is a topic I will cover on another post (learning lots from the library).

-Eric

p.s. Fred, I like the new stock analysis format. Need more numerical analysis/justification, but provides a good overview.

Max- SDDL Insider

- Posts : 297

Reputation : 7

Join date : 2010-07-01

Re: Basic market mechanics and trade types

Re: Basic market mechanics and trade types

I don't do numbers... I leave the financial analysis up to you.... then I usually do what I said I was going to in the first place... I can at least be weary of my decision knowing (if you tell me) that the company is nearly bankrupt or something.

Similar topics

Similar topics» Short Selling Mechanics

» Market conditions

» Investing in the OTC market

» Bull market spring?

» Does anyone here trade options?

» Market conditions

» Investing in the OTC market

» Bull market spring?

» Does anyone here trade options?

Page 1 of 1

Permissions in this forum:

You cannot reply to topics in this forum